Sassy Closes $2.27 Million Gander Gold Financing Including Strategic Investment by Eric Sprott

Sassy Resources Corporation (“Sassy” or the “Company”) (CSE: SASY) (OTCQB: SSYRF) (FSE: 4E7) is pleased to announce that it has closed a non-brokered private placement financing in its wholly-owned subsidiary, Gander Gold Corporation (“Gander Gold”), including a strategic investment by Mr. Eric Sprott. The private placement of 45,425,000 special warrants, issued at a price of $0.05 per special warrant, generated gross proceeds of $2,271,250. The special warrants will be converted into common shares of Gander Gold at a date to be determined by the board of directors of Gander Gold, but no later than two weeks after Gander Gold becomes a reporting issuer.

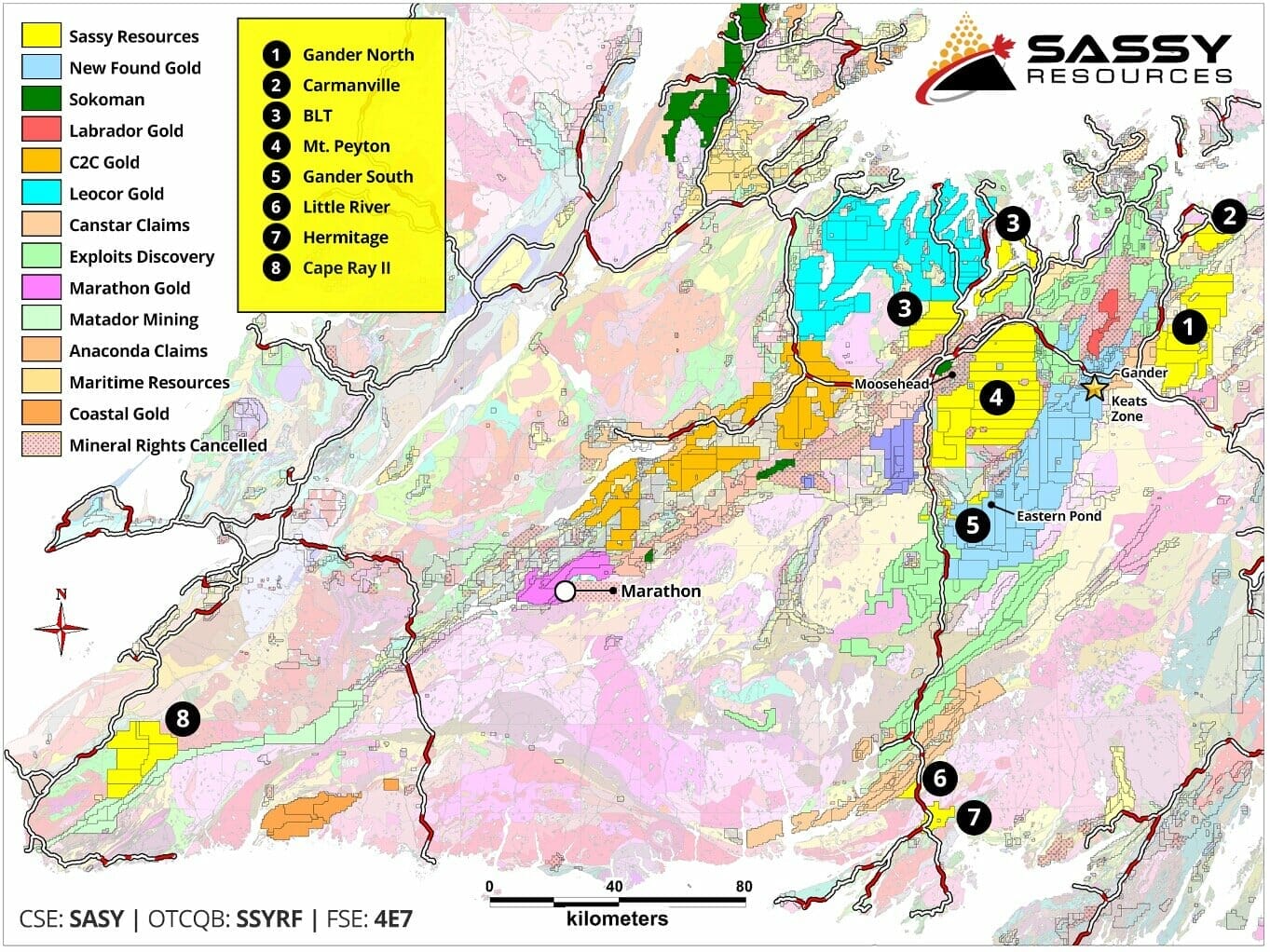

Mr. Mark Scott, Sassy President and CEO, stated: “We are very pleased to complete this financing in Gander Gold and to welcome Mr. Eric Sprott as a significant shareholder in Gander Gold. Through Gander Gold, Sassy has acquired a leading land position in the Central Newfoundland Gold Belt with some 9,032 claims under option. The Company’s first year assessment requirements are fully funded and these additional funds will allow us to execute an expanded exploration program across the 2,257 square kilometers of highly prospective ground under Sassy and Gander Gold’s control. Our discovery team is going to be aggressive and we intend to add our own share of Sassy excitement to this rapidly emerging area play. An application for the public listing of Gander Gold on a Canadian exchange will be made during the second half of the year.”

Central Newfoundland Gold Belt Map With Sassy Claims

Sassy previously purchased 105,991,667 common shares of Gander Gold at a price of $0.005 per common share, for an aggregate purchase price of $529,958.33. Combined with the private placement financing that closed on May 17, 2021, a total of $2,801,208.33 has been raised by Gander Gold. These funds will be used for initial cash payments associated with the four option agreements the Company has entered into, for exploration costs in Newfoundland and for general and administrative purposes.

There are currently a total of 105,991,667 common shares and 45,425,000 special warrants issued and outstanding in Gander Gold. No other Gander Gold warrants, options or other securities have been issued to date by the Company. The Company intends to consolidate the outstanding common shares and special warrants in Gander Gold at a ratio of 3:1 and then convert the special warrants to common shares at a later date, after which there will be a total 50,472,223 common shares issued and outstanding in Gander Gold, of which 35,330,556 (70%) will be held by Sassy. The balance (15,141,667) of the outstanding shares in Gander Gold, post-consolidation, will be held by the participants in the private placement closed on May 17, 2021.

The common shares and special warrants issued by Gander Gold are subject to resale restrictions pursuant to securities laws in Canada.

About Sassy Resources Corporation

Sassy Resources is an exploration stage resource company currently engaged in the identification, acquisition and exploration of high-grade precious metal and base metal projects in North America. Its focus is the Foremore Gold-Silver Project located in the Eskay Camp, Liard Mining Division, in the heart of Northwest B.C.’s prolific Golden Triangle, and the Central Newfoundland Gold Belt.

Caution Regarding Forward Looking Statements

Investors are cautioned that, except for statements of historical fact, certain information contained in this document includes “forward looking information”, with respect to a performance expectation for Sassy Resources Corporation. Such forward looking statements are based on current expectations, estimates and projections formulated using assumptions believed to be reasonable and involving a number of risks and uncertainties which could cause actual results to differ materially from those anticipated. Such factors include, without limitation, fluctuations in foreign exchange markets, the price of commodities in both the cash market and futures market, changes in legislation, taxation, controls and regulation of national and local governments and political and economic developments in Canada and other countries where Sassy carries out or may carry out business in the future, the availability of future business opportunities and the ability to successfully integrate acquisitions or operational difficulties related to technical activities of mining and reclamation, the speculative nature of exploration and development of mineral deposits, including risks obtaining necessary licenses and permits, reducing the quantity or grade of reserves, adverse changes in credit ratings, and the challenge of title. The Company does not undertake an obligation to update publicly or revise forward looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Some of the results reported are historical and may not have been verified by the Company.

Contact info:

Mark Scott

Chief Executive Officer & Director

info@sassyresources.ca

Terry Bramhall

Sassy Resources

Corporate Communications/IR

1.604.833.6999 (mobile)

1.604.675-9985 (landline)

terry.bramhall@sassyresources.ca

In Europe:

Michael Adams

Managing Director – Star Finance GmbH

info@star-finance.eu

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.